What Every Contractor Must Understand About Bid Bonds Before Bidding Process

What Every Contractor Must Understand About Bid Bonds Before Bidding Process

Blog Article

Important Steps to Acquire and Utilize Bid Bonds Properly

Browsing the intricacies of proposal bonds can considerably affect your success in protecting agreements. The genuine challenge exists in the precise selection of a respectable provider and the tactical use of the bid bond to enhance your competitive edge.

Understanding Bid Bonds

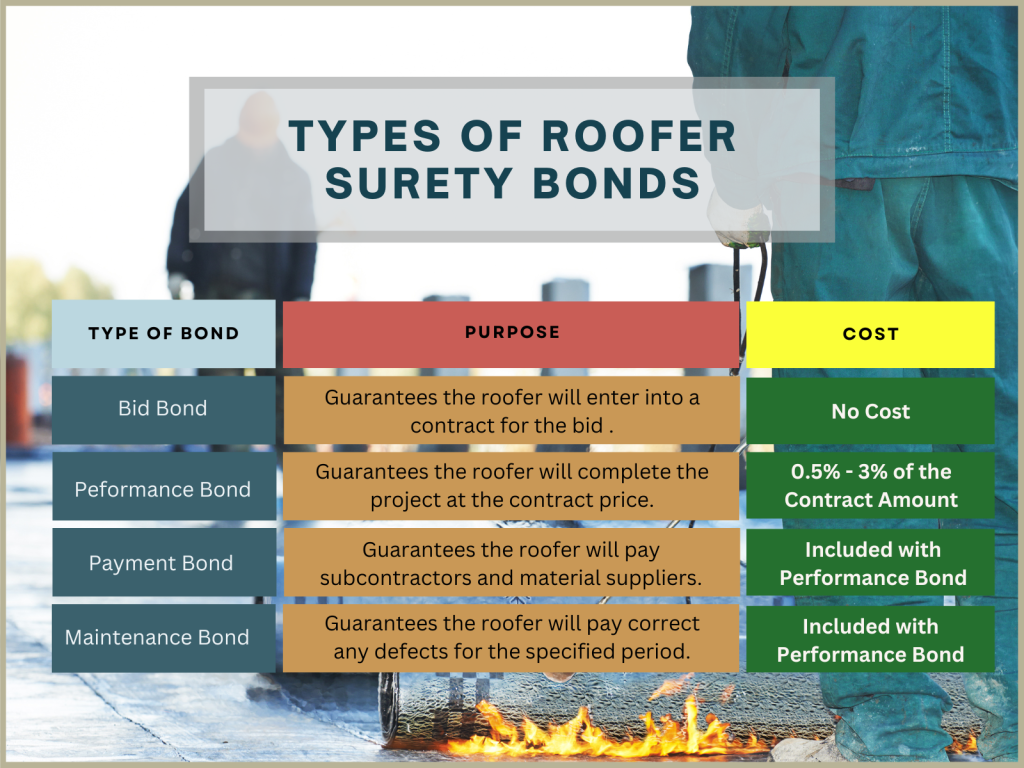

Bid bonds are a crucial component in the building and construction and contracting market, functioning as a financial guarantee that a bidder means to become part of the contract at the proposal cost if awarded. Bid Bonds. These bonds mitigate the risk for project proprietors, making certain that the chosen specialist will not only recognize the proposal however likewise protected performance and repayment bonds as required

Basically, a proposal bond acts as a protect, protecting the project owner against the economic implications of a contractor failing or taking out a bid to commence the task after selection. Normally provided by a surety business, the bond guarantees settlement to the owner, often 5-20% of the quote quantity, ought to the service provider default.

In this context, quote bonds cultivate a much more reliable and affordable bidding process atmosphere. Bid bonds play an essential role in keeping the honesty and smooth procedure of the building and construction bidding process.

Preparing for the Application

When preparing for the application of a quote bond, careful company and thorough paperwork are paramount,. A detailed evaluation of the task specs and proposal needs is vital to make certain compliance with all specifications. Beginning by assembling all required financial declarations, consisting of annual report, income declarations, and capital declarations, to demonstrate your firm's fiscal health. These records must be current and prepared by a licensed accounting professional to boost credibility.

Following, assemble a listing of previous tasks, specifically those comparable in extent and dimension, highlighting effective conclusions and any kind of awards or certifications got. This profile works as proof of your firm's capability and integrity. Furthermore, prepare a comprehensive organization plan that details your functional technique, threat management practices, and any kind of contingency intends in location. This strategy gives a holistic view of your business's method to job implementation.

Ensure that your business licenses and registrations are easily available and updated. Having these papers arranged not just speeds up the application procedure but additionally projects an expert picture, instilling self-confidence in potential guaranty providers and job proprietors - Bid Bonds. By methodically preparing these elements, you position your firm positively for successful quote bond applications

Locating a Guaranty Supplier

A guaranty business acquainted with your field will better understand the distinct dangers and demands connected with your projects. It is likewise recommended to evaluate their economic scores from agencies like A.M. Finest or Standard & Poor's, ensuring they have the financial toughness to back their bonds.

Involve with several companies to compare solutions, rates, and terms. An affordable analysis will help you secure the best terms for your bid bond. Eventually, a complete vetting process will certainly make certain a dependable collaboration, promoting confidence in your quotes and future jobs.

Sending the Application

Sending the application for a proposal bond is a critical step that needs thorough focus to detail. This process starts by gathering all pertinent documents, consisting of financial declarations, project requirements, and an in-depth business history. Ensuring the accuracy and completeness of these files is extremely important, as any disparities can bring about beings rejected or hold-ups.

When filling in the application, it is recommended to double-check all access for accuracy. This includes confirming numbers, making certain correct trademarks, and verifying that all necessary add-ons are included. Any kind of omissions or mistakes can undermine your application, triggering unnecessary difficulties.

Leveraging Your Bid Bond

Leveraging your quote bond properly can significantly improve your one-upmanship in protecting contracts. A quote bond not only shows your economic security however likewise reassures the project owner of your dedication to meeting the agreement terms. By showcasing your quote bond, you can highlight your firm's reliability and trustworthiness, making your quote attract attention among countless competitors.

To leverage your bid bond to its maximum capacity, guarantee it is offered as component of a detailed bid bundle. Highlight the toughness of your guaranty copyright, as this shows your business's monetary wellness and functional capability. In addition, highlighting your track document of efficiently finished jobs can even more impart confidence in the project owner.

In addition, preserving close interaction with your guaranty service provider can help with much better terms in future bonds, therefore strengthening your competitive positioning. An aggressive technique to managing and restoring your bid bonds can additionally prevent lapses and make sure continual insurance coverage, which is important for continuous job procurement initiatives.

Conclusion

Effectively getting and using quote bonds necessitates thorough preparation and tactical implementation. By thoroughly arranging essential documents, selecting a respectable surety supplier, and sending a complete application, companies can secure the necessary bid bonds to boost their competitiveness. Leveraging these bonds in proposals highlights the firm's integrity and the toughness of the surety, inevitably raising the chance of safeguarding agreements. Continuous interaction with the guaranty supplier makes certain future possibilities for successful task proposals.

Determining a trusted guaranty copyright is a critical step in protecting a bid bond. A proposal bond not only shows your economic stability however likewise additional reading comforts the task owner of your dedication to satisfying the contract terms. Bid Bonds. By showcasing your bid bond, you can highlight your company's dependability and credibility, making your bid stand out amongst numerous competitors

To utilize your quote bond to its max potential, ensure it is provided as part of a comprehensive bid package. By adequately organizing vital documents, choosing a reputable guaranty provider, and submitting a complete application, firms can secure the necessary bid bonds to enhance their competitiveness.

Report this page